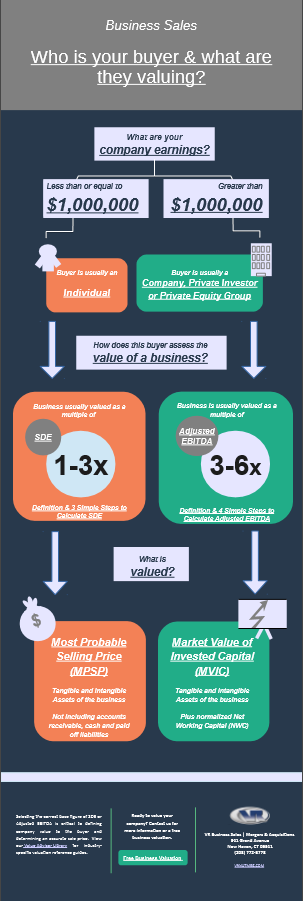

How to Calculate SDE

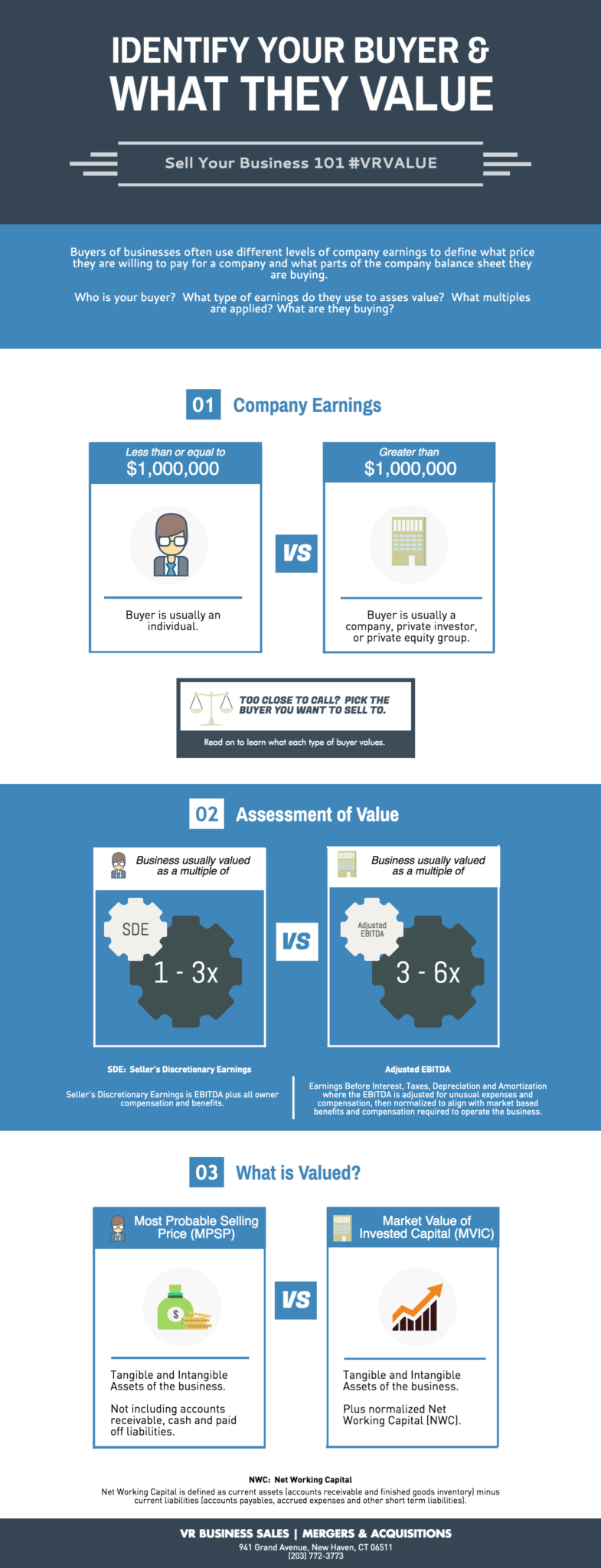

VR New Haven2018-01-05T14:20:47-05:00If you are trying to find Seller's Discretionary Earnings (SDE) for your business but don't know where to start - this infograph is for you! View image below or check out our PDF printer-friendly version. View or Print PDF