Adjusted EBITDA1 and SDE2 are common base figures used in calculating company value. Selecting which to use is imperative in determining the sale price of a business and defining what that value is.

Adjusted EBITDA1 and SDE2 are common base figures used in calculating company value. Selecting which to use is imperative in determining the sale price of a business and defining what that value is.

General Rules of Thumb

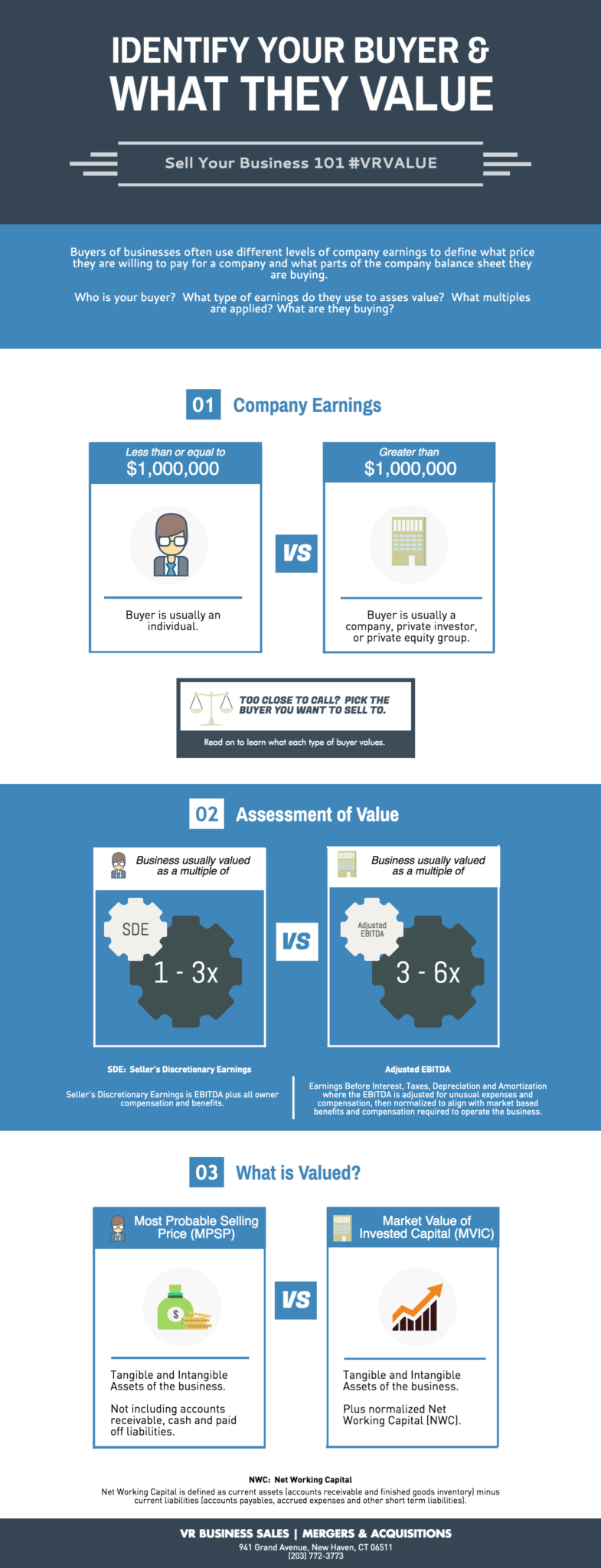

- Companies are usually valued at 3-6 times adjusted EBITDA or 1-3 times SDE.

- Earnings less than $1,000,000, use SDE for company valuation.

- Earnings $1,000,000 or more, use adjusted EBITDA for company valuation.

If interested parties are individual buyers who will become owner-operators, it is important to calculate the full economic benefit to the new owner. In this case, you should use SDE, Seller’s Discretionary Earnings. This figure includes all owner compensation and benefits as is, someone buying a job is seeking a lifestyle and interested in how much money they can personally make. In transactions where value is based on a multiple of SDE, the deal structure is generally an asset sale where tangible and intangible assets of the business are sold. An asset sale sometimes includes inventory of the business, but does not include the cash, accounts receivable nor any short or long term liabilities of the business.

If interested parties are other companies, private investors or private equity groups (PEGs), then the value they wish to define is the Market Value of Invested Capital (MVIC) or Enterprise Value of the company. The MVIC or Enterprise Value of a company is generally defined by a multiple of adjusted EBITDA, Earnings Before Interest, Taxes, Depreciation and Amortization where compensation and benefits of the owner are normalized to align with market based benefits and compensation required to operate the business. Essentially, the buyer will need to replace you within your business but compensation should represent market costs and not necessarily what you pay yourself. In a transaction where value is based on MVIC, the deal structure is also an asset sale that includes all the tangible and intangible assets of the business plus the normalized Net Working Capital (NWC) of the business. NWC is defined as current assets (accounts receivable and finished goods inventory) minus current liabilities (accounts payables, accrued expenses and other short term liabilities). Adding NWC to the tangible and intangible assets of the business, creates an important distinction between businesses valued as a multiple of SDE and those valued as a multiple of adjusted EBITDA.

Note: This is only general guidance and such calculations do not constitute a complete valuation. A professional valuation is strongly recommended to determine an accurate sale price. Contact us for a free, simple business valuation.

Related Post: 4 Simple Steps to Calculating Adjusted EBITDA, 6 Key Factors Impacting Business Valuations + PDF Printable Guide, 3 Simple Steps to Calculating SDE

Footnotes:

1 Adjusted EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization where the EBITDA is adjusted for unusual expenses and compensation, then normalized to align with market based benefits and compensation required to operate the business. 2 SDE: Seller’s Discretionary Earnings is EBITDA plus all owner compensation and benefits.