Welcome to our “How to Sell” series with industry-specific information on how companies are valued and key factors affecting final sale price.

View and print valuation guide: Product Manufacturing Value Advisor

Industry Definition

Manufacturers of products for a variety of industries who are not contract manufacturers (job shops).

Key Valuation Considerations

- Industries Served: The range for valuation multiples fluctuations based upon company size and industries served. Companies with revenues over $2 million generally secure higher multiples. Overall product manufacturers tend to receive higher multiples than job shops, generally because of the proprietary nature of what they manufacture. This makes them attractive to strategic buyers that are seeking to create more value with their own product offerings. Anything in the medical device or aerospace manufacturing sector command the highest multiples. Contact us for guidance on basic valuation multiples for the product type of your company. Keep in mind that the valuation processes is complex and the information we provide here is only to provide some very basic guidance and foundational knowledge.

- Customer Concentration: Reliance on a few key customers will drive down valuations multiples and affect payment terms as it poses significant risk to the buyer. This is particularly true when customer relationships are directly tied to the owner(s) exiting the business. Companies sold with a high customer concentration often have deferred payment terms where the proceeds from the sale are paid over the course of years and vary based upon revenues and retention. Long-term contracts with key customers may negate risk associated with higher customer concentration. In general, higher multiples are awarded when no one customer accounts for more than 10% of sales. Problems may arise with prospective buyers if a customer accounts for over 30% of revenues.

- Equipment: Company profits are directly linked to manufacturing expertise and operating efficiency. Type, age and condition of equipment is a critical consideration along with machinery run rates. Machines with modern technology, including automation, and a diverse set of capabilities are highly valued. The need to update, replace, and purchase new machinery will be taken into consideration by buyers in the form of additional CapEx (Capital Expenditures) that will be required to remain competitive and gain market share. The need to for additional investments will negatively affect valuation multiples and final sale price.

- Management Team: Overdependence on an owner can manifest itself in a variety of ways, such as not hiring or developing other management members or personally managing key customer relationships. A well-rounded management team will command higher valuation multiples and give buyers confidence that the business will continue to run smoothly after the owner exits. If management, or the company in general, is heavily dependent on the owner, the final sale price and terms will be affected and the owner may be required to stay on for a certain period of time to help transition the business. A company that is overdependent on owners may struggle to find willing buyers.

- Other Important Considerations:

- Proprietary Products & Processes

- Capital Requirements

- Reputation

- Certifications

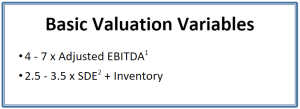

These are only a few variables. A professional valuation is strongly recommended for accuracy. Contact us for a simple, free valuation today or for information on our full suite of valuation services.

Footnotes

1 Adjusted EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization where the EBITDA is adjusted for unusual expenses and compensation, then normalized to align with market based benefits and compensation required to operate the business.

2 SDE: Seller’s Discretionary Earnings is EBITDA plus all owner compensation and benefits.