2021 First Quarter Review: Challenges, Optimism & Trends

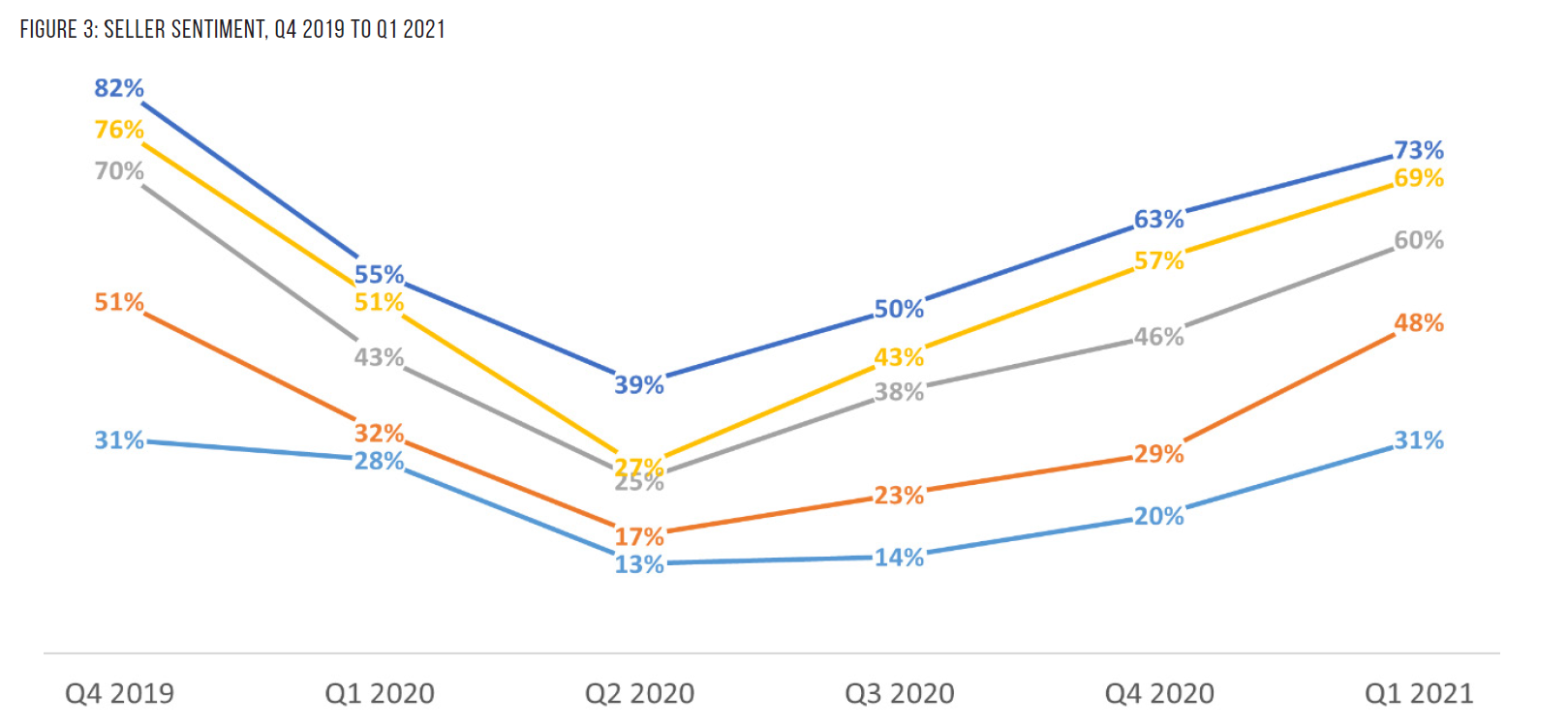

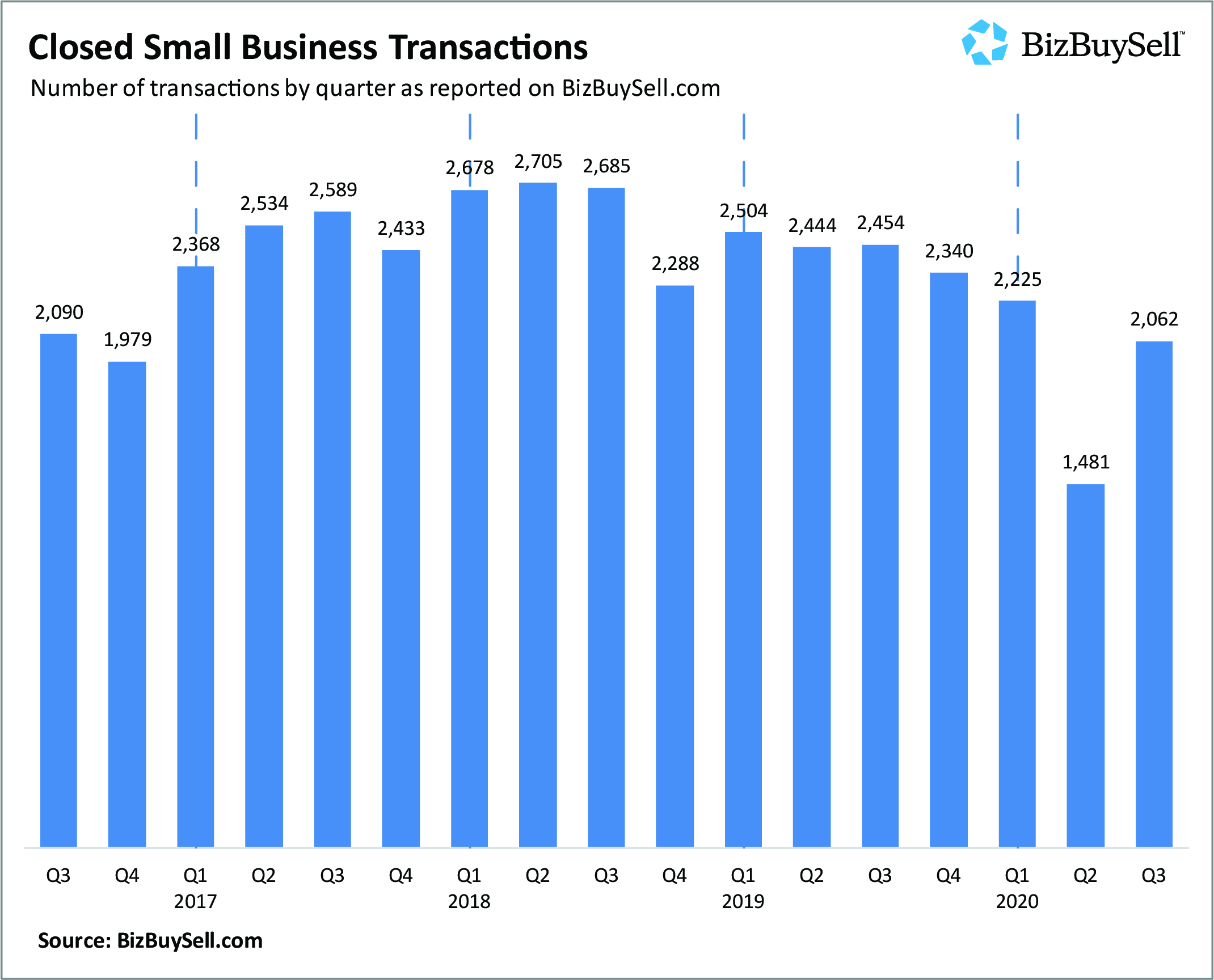

VR New Haven2021-06-02T11:15:55-04:00First Quarter - Market Outlook 2021 The first quarter has show growth in confidence and optimism among business owners and M&A professionals alike. Valuation multiples and deal flow are expected to increase in the next three months, according to the first quarter Market Pulse Report. A shortage of strong performing businesses has driven [...]