Welcome to our “How to Sell” series with industry-specific information on how companies are valued and key factors affecting final sale price.

View and print valuation guide: Mechanical Contractors Value Advisor

Industry Definition

Mechanical Contractors who install and service plumbing, heating and air conditioning equipment.

Key Valuation Considerations

- Business Mix: Certain products and services are more profitable than others and a strong company has the right mix of offerings to remain competitive and optimize profit margins. Business mix drives value and many plumbing companies are adding HVAC and vice versa. The right mix will depend on the local market, but the important point is cross-selling your customer base. Servicing residential or commercial clients (and what industries serviced within commercial) will also impact buyer perceptions and the appropriate mix of services. One very appealing product is offering service agreements to create recurring revenues, which we discuss below. The average profit margin within the industry, according to the Business Reference Guide 2013, is 5.4%. It is important for owners of these companies to assess the revenues each service brings in and to focus on building the higher profit products and services.

- Recurring Revenues: Repeat customers and recurring revenue sources are important for HVAC and Plumbing contractors to maintain profitability. Annual or long-term service agreements provide reliable revenues that can help with seasonal profit cycles. Companies that don’t offer service agreements are likely missing out on additional revenues and may receive lower valuation multiples. Establishing recurring revenues will help to offset any buyer concerns of customer loss upon owner exit and reduce risks of high customer concentration. More recurring revenues on the books results in higher valuation multiples.

- Skilled Employees: Company profitability is dependent on the expertise and skill of its employees, especially their ability to complete projects on time and within budget. Attracting and retaining qualified contractors is important, but is also becoming increasingly difficult. High industry growth coupled with the retirement of experienced, baby boomer contractors has created a gap between demand and talent available. Some firms are working with high schools and technical colleges to create a pipeline for talent. Having such programs will bode well with buyers and lessen concerns of losing employees, particularly if there are contractors on staff nearing retirement. Understaffed businesses and those struggling to hire qualified talent will receive lower valuations, especially if there are outstanding HR and customer issues due to under performance or negligence. Certifications are also important as certain licenses are likely required based upon the type of work performed. If the owner is the only licensed employee, prospect buyers who do not already have the required license will likely dismiss the opportunity.

- Management Team: In contractor services, it is common for owners to be hands on in day-to-day operations in a way that makes the business reliant on them. This could manifest itself in a variety of ways, such as performing specialized contract work tasks, not hiring or developing other management members, or by personally managing all customer relationships. A well-rounded management team will command higher valuation multiples and give buyers confidence that the business will continue to run smoothly after the owner exits. If management, or the company in general, is heavily dependent on the owner, the final sale price and terms will be affected and the owner may be required to stay on for a certain period of time to help transition the business. A company that is overdependent on owners may struggle to find willing buyers.

- Other Important Considerations:

- Value Added Services

- Customer Concentration

- Capital Requirements

- Reputation

- Industries Served

- Local/Regional Market Share

These are only a few variables. A professional valuation is strongly recommended for accuracy. Contact us for a simple, free valuation today or for information on our full suite of valuation services.

Footnotes

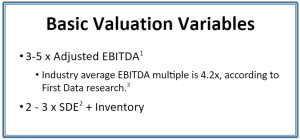

1 Adjusted EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization where the EBITDA is adjusted for unusual expenses and compensation, then normalized to align with market based benefits and compensation required to operate the business.

2 SDE: Seller’s Discretionary Earnings is EBITDA plus all owner compensation and benefits.

3Based upon statistics from M&A Source, First Research reports stating average Market Value of Invested Capital/EBITDA is 4.2 for Plumbing & HVAC Contractors (2-8-16).